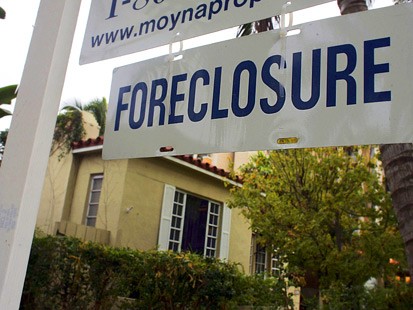

Lenders took back more homes in August than in any month since the start of the U.S. mortgage crisis.

The increase in home repossessions came even as the number of properties entering theforeclosure process slowed for the seventh month in a row, foreclosure listing firm RealtyTrac Inc. said Thursday.

In all, banks repossessed 95,364 properties last month, up 3 percent from July and an increase of 25 percent from August 2009, RealtyTrac said.

August makes the ninth month in a row that the pace of homes lost to foreclosure has increased on an annual basis. The previous high was in May.

Banks have been stepping up repossessions to clear out their backlog of bad loans with an eye on eventually placing the foreclosed properties on the market, but they can't afford to simply dump the properties on the market.

Concerns are growing that the housing market recovery could stumble amid stubbornly high unemployment, a sluggisheconomy and faltering consumer confidence. U.S. home sales have collapsed since federal homebuyer tax credits expired in April.

That's one reason fewer than one-third of homes repossessed by lenders are on the market, said Rick Sharga, a senior vice president at RealtyTrac.

"These (properties) are going to come to market, but very slowly because nobody wants to overwhelm a soft buyer's market with too much distressed inventory for fear of what it would do for house prices," he said.

As a result, lenders are putting off initiating the foreclosure process on homeowners who have missed payments, letting borrowers stay in their homes longer.

No comments:

Post a Comment