Any number of pundits claim that we have now passed the worst of the recession. Green shoots of recovery are supposedly popping up all around the country, and the economy is expected to resume growing soon at an annual rate of 3% to 4%. Many of these are the same people who insisted that the economy would continue growing last year, even while it was clear that we were already in the beginning stages of a recession.

A false recovery is under way. I am reminded of the outlook in 1930, when the experts were certain that the worst of the Depression was over and that recovery was just around the corner. The economy and stock market seemed to be recovering, and there was optimism that the recession, like many of those before it, would be over in a year or less. Instead, the interventionist policies of Hoover and Roosevelt caused the Depression to worsen, and the Dow Jones industrial average did not recover to 1929 levels until 1954. I fear that our stimulus and bailout programs have already done too much to prevent the economy from recovering in a natural manner and will result in yet another asset bubble.

Anytime the central bank intervenes to pump trillions of dollars into the financial system, a bubble is created that must eventually deflate. We have seen the results of Alan Greenspan's excessively low interest rates: the housing bubble, the explosion of subprime loans and the subsequent collapse of the bubble, which took down numerous financial institutions. Rather than allow the market to correct itself and clear away the worst excesses of the boom period, the Federal Reserve and the U.S. Treasury colluded to put taxpayers on the hook for trillions of dollars. Those banks and financial institutions that took on the largest risks and performed worst were rewarded with billions in taxpayer dollars, allowing them to survive and compete with their better-managed peers.

This is nothing less than the creation of another bubble. By attempting to cushion the economy from the worst shocks of the housing bubble's collapse, the Federal Reserve has ensured that the ultimate correction of its flawed economic policies will be more severe than it otherwise would have been. Even with the massive interventions, unemployment is near 10% and likely to increase, foreigners are cutting back on purchases of Treasury debt and the Federal Reserve's balance sheet remains bloated at an unprecedented $2 trillion. Can anyone realistically argue that a few small upticks in a handful of economic indicators are a sign that the recession is over?

What is more likely happening is a repeat of the Great Depression. We might have up to a year or so of an economy growing just slightly above stagnation, followed by a drop in growth worse than anything we have seen in the past two years. As the housing market fails to return to any sense of normalcy, commercial real estate begins to collapse and manufacturers produce goods that cannot be purchased by debt-strapped consumers, the economy will falter. That will go on until we come to our senses and end this wasteful government spending.

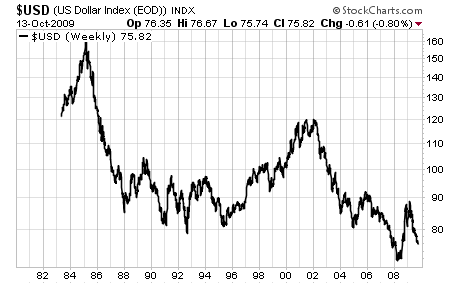

Government intervention cannot lead to economic growth. Where does the money come from for Tarp (Treasury's program to buy bad bank paper), the stimulus handouts and the cash for clunkers? It can come only from taxpayers, from sales of Treasury debt or through the printing of new money. Paying for these programs out of tax revenues is pure redistribution; it takes money out of one person's pocket and gives it to someone else without creating any new wealth. Besides, tax revenues have fallen drastically as unemployment has risen, yet government spending continues to increase. As for Treasury debt, the Chinese and other foreign investors are more and more reluctant to buy it, denominated as it is in depreciating dollars.

The only remaining option is to have the Fed create new money out of thin air. This is inflation. Higher prices lead to a devalued dollar and a lower standard of living for Americans. The Fed has already overseen a 95% loss in the dollar's purchasing power since 1913. If we do not stop this profligate spending soon, we risk hyperinflation and seeing a 95% devaluation every year.

Ron Paul is a Republican congressman from Texas.